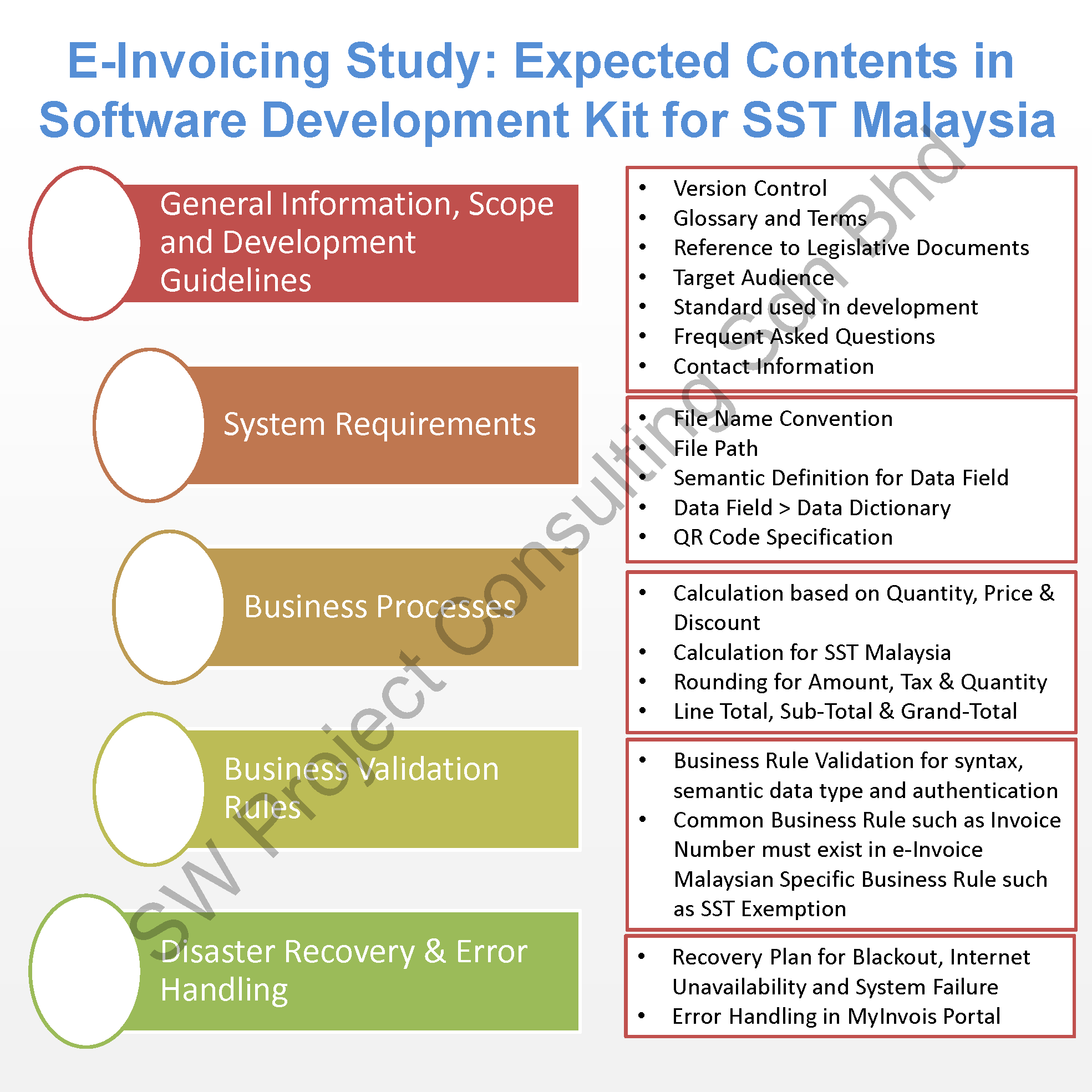

E-Invoicing Study: Anticipated Components in Software Development Kit Related to SST Malaysia.

As Malaysia is using Sales Tax and Service Tax as single tier indirect tax without input tax claim, the SDK shall consider issuing additional guideline while adopting Peppol or other standard in the development of E-Invoice. Majority of E-Invoice will not display tax value except SST and Tourism Tax.

The software development kit shall consider of the following sections:

- General Information, Scope, and Development Guidelines

- The SDK shall consist of general information about the purpose, scope, and target audience of this guide. It provides version control as to the changes in the SDK as well as providing a glossary of terms in the document.

- The next valuable piece of information is that the SDK must refer to the legislative documents that empower the development of E-Invoice.

- SDK shall highlight as to what standards to be used. For example, PEPPOL BIS, UBL and Malaysia specified standard related to Sales Tax and Service Tax (SST).

- It shall provide FAQ to address frequent questions to be asked by the audience and contact information for software developers to raise if any clarification is required.

- System Requirements

- The file name of the transmitted e-invoice must be unique so that no two businesses submit the e-invoices with the same file name.

- The file path is to store the cleared invoice and easy reference for the user to locate it

- Semantic definition for each data field stated in the guideline. Whether this is date, number, percentage, text fields etc. The SDK shall address to the maximum length of each data field that is used to keep bulk contents, for instance, invoice number reference for consolidated e-invoice on monthly basis.

- The data field released in the specific guideline shall map to the data dictionary, whether we follow PEPPOL or any other standards.

- QR Code specification can help the software developer to create QR code and is easy for verification purpose.

- Business Processes

- The SDK shall provide complete lists of common business processes that are defined in e-invoice development. For example, a business process requires whether an e-invoice has a valid invoice reference number. Calculation of the price, quantity and discount are correctly at item line as well as sub-total and grand total.

- Since Malaysia is using sales tax and service tax (SST), the SDK shall publish a set of business processes related to SST transactions in Malaysia. As e-invoice may consist of sales tax or service tax exemption, the business rule needs to check whether the exemption certificate is available before the tax value field is calculated as zero instead of tax value.

- The rounding mechanism is also important for quantity, price and total. The SDK shall give an example of how the rounding works.

- Item line total aggregate must be tally with sub-total and grand total.

- Business Validation Rules

- The common business validation rules shall check the semantic data types as date and time, percentage, numeric and text data fields. The business validation rule shall cross-check the validity of NRIC, TIN, BRN and SST ID while it shall not check if it is foreign passport number.

- Other common business validation rules from Peppol and EN 16931 shall also apply to e-invoices. For example, an e-invoice must consist of an invoice reference number.

- The SDK shall publish a set of Malaysia-specified business validation rules such as Sales Tax and Service Tax calculation and sales tax exemption certificate validation.

- Disaster Recovery and Error Handling

- The SDK shall suggest and recommend disaster recovery plans related to blackouts, Internet Unavailability in rural areas, and system failure handling procedures.

- The SDK shall publish the error-handling procedure and reporting related to tax authority portal (MYINVOIS Portal) unavailability.