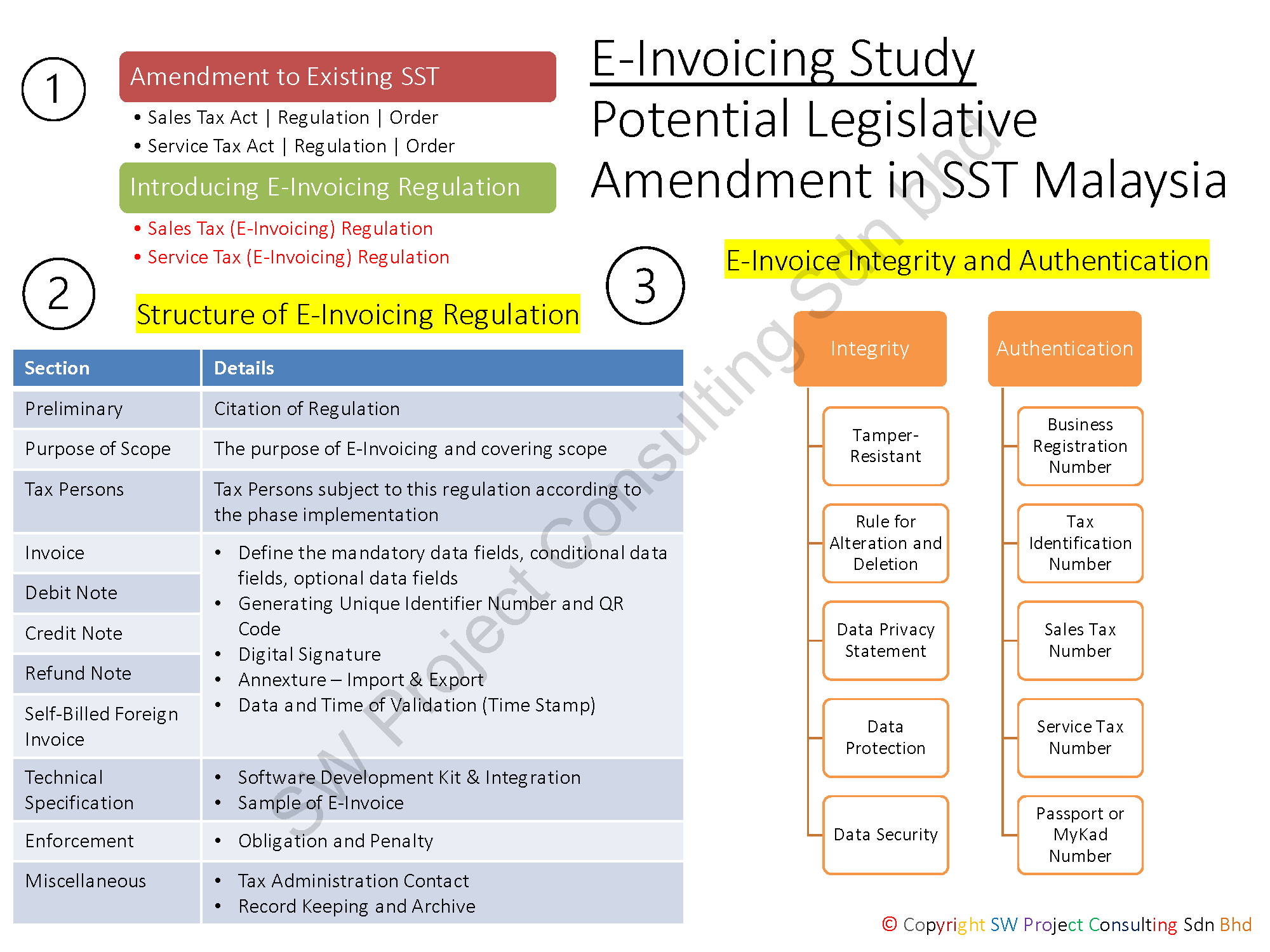

The following slide is an illustration for e-invoicing study - potential legislative amendment in SST Malaysia.

The indirect tax mechanism in Malaysia is a single-stage sales and service tax (SST). It comprises of two independent mechanisms, sales tax, and service tax. respectively.

The indirect tax mechanism in Malaysia is a single-stage sales and service tax (SST). It comprises of two independent mechanisms, sales tax, and service tax. respectively.

To implement electronic invoice or E-Invoice to cover the invoice generation process in SST registrants, the following act needs to be amended and accommodated for whatever impacts to the operation of SST.

- Sales Tax Act 2018

- Service Tax Act 2018

- Sales Tax Regulation (amendment and new legislative document)

- Service Tax Regulation (amendment and new legislative document)

- Sales Tax Order (amendment and new legislative document)

- Service Tax Order (amendment and new legislative document)

If the government introduces new legislative document for E-Invoicing project, the following could be new legislative documents:

- Sales Tax (E-Invoicing) Regulation

- Service Tax (E-Invoicing) Regulation

There are a number of amendments to be made in the E-Invoicing Regulation such as the following:

- Mention about the definition, purpose, and scope of E-Invoicing and how the E-Invoicing is operating in Malaysia

- Tax Persons or SST registrants' involvement in the phase implementation of E-Invoicing project

- Requirements for the business documents such as invoice, credit note, debit note, refund note and self-billed foreign invoice. Amendment details could be some of the details mentioned in the above slide.

- Technical specification - Release of software development kit and integration model. It would be great to provide a sample of XML E-Invoice and whether allow software developer to share PDF/A-3 (with XML embedded) compliant with the buyer.

- Enforcement will highlight on those responsibilities and obligation of the tax administration and SST registrants

- Miscellaneous will highlight on the contact of tax administration division and the method for record keeping and archive mechanism.

E-Invoicing implementation project shall highlight in term of integrity and authentication of E-Invoice as below:

- The integrity of an E-Invoice:

- E-Invoice shall be tamper-resistant for any unlawful changes

- E-Invoice procedure rules on alteration and deletion before validation

- Data privacy statement, Data Protection and Data Security in MyInvois Portal

- The authenticity of an E-Invoice:

- Business Registration Number (BRN)

- Tax Identification Number (TIN)

- Sales Tax Registration Number

- Service Tax Registration Number

- Passport or MyKad Number

Disclaimer:

The above illustration slide is for E-Invoicing study purposes. The views expressed in this article are the author's own views. You must not rely on the information on the slide as an alternative to solicit advice from another appropriately qualified professional.