E-Invoicing

This category is to group E-Invoicing articles together

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 455

I would like to invite you and your colleagues to attend the online seminar - E-Invoicing Updates and Self-Billed Transactions on March 10, 2025 (Monday) [09:00 ~ 17:30]. Total 7.5 hours online seminar.

In this seminar, we will include a session to discuss the latest E-Invoicing updates announced on 22/02/2025 and the response to the updates. We will also discuss gap assessment analysis re-look on e-invoicing based on the latest updates from the tax authority. We will walk through all types of self-billed E-Invoice transactions, whether it is individual or consolidated self-billing. We will address the critical issues in this seminar. We will explore on how to enter the consolidated E-Invoice and self-billed E-Invoice in MyInvois Portal during the grace period. As we are moving for Phase 2 to Phase 4 implementation, staff claim that involves e-Invoice, receipt or self-billed e-Invoice are critical mechanism to be handled by the business.

Here are the top nine reasons why it is important to attend this workshop:

Please download the training flyer via the download link or register using Online Form:

In-Person Seminar - E-Invoicing Updates and Self-Billed Transactions

You can scan the QR Code to download to your mobile device using Wechat or QR Scanner.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 476

I would like to invite you and your colleagues to attend the online seminar - E-Invoicing Updates and Self-Billed Transactions on April 18, 2025 (Friday) [09:00 ~ 17:30]. Total 7.5 hours online seminar. IT IS MANDARIN but with English note.

In this seminar, we will include a session to discuss the latest E-Invoicing updates announced on 18/03/2025 and the response to the updates. We will also discuss gap assessment analysis re-look on e-invoicing based on the latest updates from the tax authority. We will walk through all types of self-billed E-Invoice transactions, whether it is individual or consolidated self-billing. We will address the critical issues in this seminar. We will explore on how to enter the consolidated E-Invoice and self-billed E-Invoice in MyInvois Portal during the grace period. As we are moving for Phase 2 to Phase 4 implementation, staff claim that involves e-Invoice, receipt or self-billed e-Invoice are critical mechanism to be handled by the business.

Here are the top nine reasons why it is important to attend this workshop:

Please download the training flyer via the download link or register using Online Form:

Online Seminar - E-Invoicing Updates and Self-Billed Transactions (Mandarin)

You can scan the QR Code to download to your mobile device using Wechat or QR Scanner.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 954

I would like to invite you and your colleagues to attend the Online Seminar - The Essentials of E-Invoicing in Malaysia on March 21, 2024 (Thursday) [09:00 ~ 17:30]. Total 7.5 hours online seminar.

In this online seminar, we will include a session to discuss preparation for e-invoicing in Malaysia. We will also discuss gap assessment analysis on e-invoicing based on the overseas best practice. In addition, applying proper implementation strategies and vendor selection are crucial factors to ensure the success rollout of E-Invoice in the organization.

Here are the top nine reasons why it is important to attend this workshop:

Please download the training flyer via the download link or register using Online Form:

Online Seminar - The Essentials of E-Invoicing in Malaysia

You can scan the QR Code to download to your mobile device using Wechat or QR Scanner.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1005

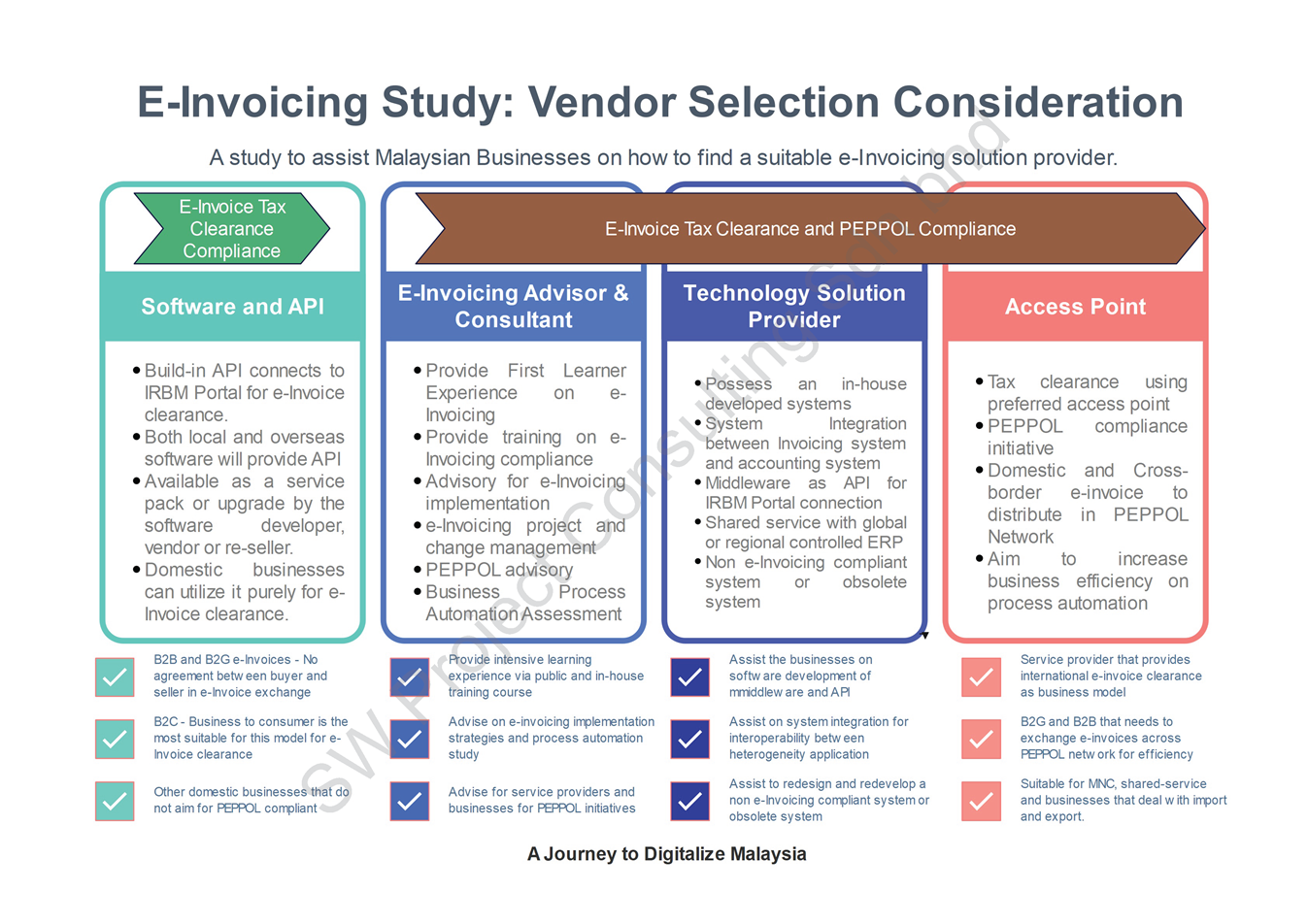

E-Invoicing Study: E-Invoicing Vendor Selection Consideration

As Malaysia is implementing E-Invoice in 2024, there are a number of service providers that wish to tender their E-Invoicing services to the businesses. In order to source for the correct type of vendor, businesses may consider the following criteria:

- Software and API (Application Programming Interface)

- This is a built-in API that is able to connect and sign-into IRBM MyInvois Portal for e-Invoice clearance. Software vendor and software developer will build the API accordidng to the guide issued by IRBM.

- Both local software and international software vendors including ERP vendors are capable to develop the API once the SDK is available and specification parameters are known.

- The vendor may provide the API to the businesses in the form of software upgrade or service pack to be installed in the current system in order to enjoy the benefits of e-Invoice clearance in IRBM Portal.

- It is very suitable for domestic businesses that owned a software, using cloud or software as a service. The main purpose of the business consideration is for tax compliance and e-Invoice clearance and validation.

- It is able to fit the domestic businesses that involve B2G, B2B and B2C that both seller and buyer will agree no exchange in e-invoices network.

- Domestic businesses that involve only in B2C will also find this model suitable for e-Invoice clearance. The consumer will accept the e-Invoice validated by IRBM from the seller.

- Other domestic businesses that do not aim for PEPPOL interoperability may choose this model, despite of the software may offer for PEPPOL features as well.

- E-Invoicing Advisor and Consultant

- These are the advisors that provide first learner experience on e-Invoicing to the businesses. Businesses may choose to engage the advisors if the business model is complex and needs guidance from the third party advisors.

- The advisor may provide E-Invoicing training, implementation, gap assessment, change management, business processes automation and other related e-Invoicing compliance to the businesses. The businesses may get updates and progress from time to time.

- The advisor can arrange in any form of online seminar, in-person workshop and in-house training to the public. They may advise on implementation strategies and offer process automation study to the businesses.

- It is able to fit the businesses who opt for tax compliance via e-Invoice clearance and PEPPOL interoperability implementation. The businesses shall engage these advisors to monitor the timeline and deliverables.

- Technology Solution Provider

- If the business possessed an in-house developed system, legacy system, non e-Invoicing compliant system or obsolete system, it is helpful to engage a technology solution provider to look for technical solution to fit in the e-Invoicing implementation. It is whether to continue with the existing solution or sourcing for new application.

- Businesses that use different systems for invoicing, billing, accounting and other front-end e-commerce solutions, the technology solution provider may be helpful to develop middleware for system integration between heterogeneity systems.

- Technology solution provider may develop an API or middleware for the businesses that use regional or grabal controlled ERP that local customization is not possible. Many MNC and shared service hub may consider third party technology service provider to manage technical request for local e-invoicing compliance and global IT resources.

- Technology solution provider may be able to assist in redesign and redevelop any non e-Invoicing compliant system or obsolete system upon request.

- MNC and shared service hubs that aim for e-Invoice clearance compliance and PEPPOL interoperability may consider technology solution provider to finetune and enhance the current system constraints.

- Access Point

- The main commercial model for access point is to provide e-Invoice clearance with tax authorities and exchange of e-Invoices within PEPPOL network.

- There are many international access point service providers that are ready to provide e-Invoicing tax clearance and distribution of e-Invoices via PEPPOL network. Local access points are currently being developed by MDEC and soon to be known the list of approved local and international access point operators.

- The distribution of e-Invoices aims to increase business efficiency via process automation.

- Businesses that involve in B2B and B2G that need to exchange e-Invoices via PEPPOL network shall consider access point for clearance compliance and distribution of e-Invoice with seamless interface.

- MNC, share service hub and businesses that deal with cross-border such as import and export may consider access point operator.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 1421

I would like to invite you and your colleagues to attend the Online Seminar - The Essentials of E-Invoicing in Malaysia on December 28, 2023 (Thursday) [09:00 ~ 17:30]. Total 7.5 hours online seminar.

In this online seminar, we will include a session to discuss preparation for e-invoicing in Malaysia. We will also discuss gap assessment analysis on e-invoicing based on the overseas best practice. In addition, applying proper implementation strategies and vendor selection are crucial factors to ensure the success rollout of E-Invoice in the organization.

Here are the top nine reasons why it is important to attend this workshop:

Please download the training flyer via the download link or register using Online Form:

Online Seminar - Sales Tax Exemption, Imported Service Tax and E-Invoicing Preparation

You can scan the QR Code to download to your mobile device using Wechat or QR Scanner.

- Details

- Written by: Administrator

- Category: E-Invoicing

- Hits: 692

I would like to invite you and your colleagues to attend the Online Seminar - The Essentials of E-Invoicing in Malaysia on January 23, 2023 (Tuesday) [09:00 ~ 17:30]. Total 7.5 hours online seminar.

In this online seminar, we will include a session to discuss preparation for e-invoicing in Malaysia. We will also discuss gap assessment analysis on e-invoicing based on the overseas best practice. In addition, applying proper implementation strategies and vendor selection are crucial factors to ensure the success rollout of E-Invoice in the organization.

Here are the top nine reasons why it is important to attend this workshop:

Please download the training flyer via the download link or register using Online Form:

Online Seminar - The Essentials of E-Invoicing in Malaysia

You can scan the QR Code to download to your mobile device using Wechat or QR Scanner.